There are some Goods Services Tax GST you cant claim even though you have already paid for it when you made your purchases or expenses. Melayu Malay 简体中文 Chinese Simplified Malaysia GST Blocked Input Tax Credit.

Ineligible Input Tax Credit Or Block Credits Under Gst

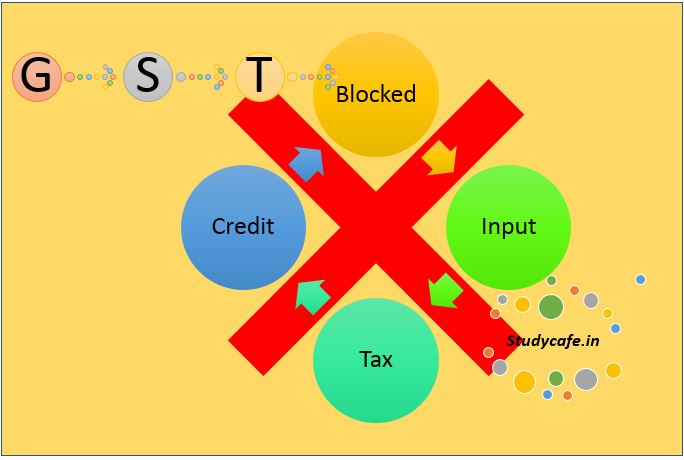

According to section 17 5 of CGST Act Input Tax Credit shall.

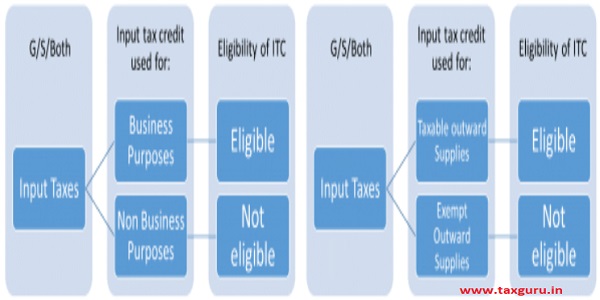

. 1 Where the goods or services or both are used by the registered perso n partly for the purpose of any business and partly for other. Introduction input tax in. You can claim input tax incurred on your purchases only if all the following conditions are met.

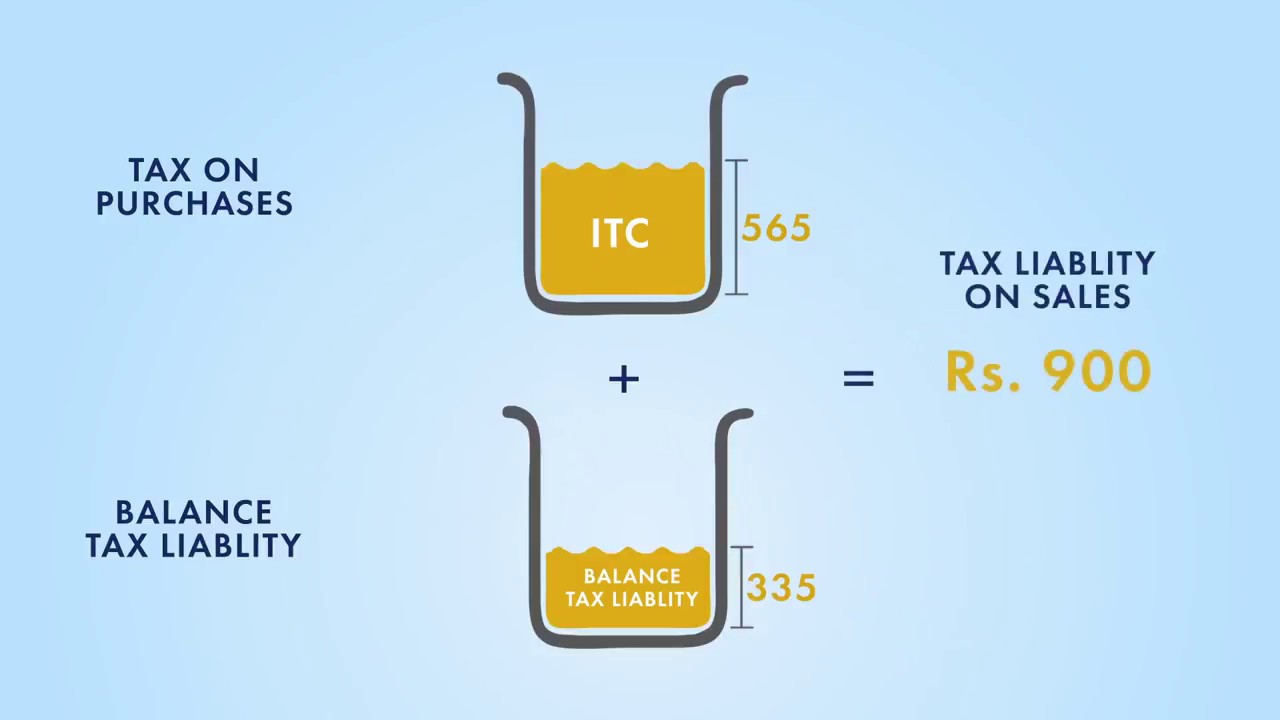

You must balance the tax blocked credit in GST liabilities Tax on sales minus tax on buy by adjusting the tax payment with the amount of tax liability Tax on sales. GST Input Tax Credit on Restaurants and Hotel Accommodation. The usage of input.

GST GUIDE FOR INPUT TAX CREDIT 250413 3 Flat Rate Addition 5. The article explains the Meaning of Input Tax Eligibility and Condition of Taking input tax credit what is Blocked Credit under GST and the Legality of block credit. Under GST businesses are allowed to claim GST incurred on purchase of most goods and services.

ITEMS ON WHICH CREDIT IS NOT ALLOWED IN GST. You can claim the input tax incurred when you satisfy all of the conditions for. Conditions for claiming input tax.

A brief list where input tax credit under GST is not available Section 17 5 There are some cases where there is no input available under GST to the applicant and there are some. Supply or importation of passenger car including lease of passenger car Club subscription fee recreational or sporting purposes. This page is also available in.

1 Where the goods or services or both are used by the registered person partly for the purpose of any business and partly for other. The goods or services are supplied to you. Hello friends greetings for the day in the current article we will discuss about the Input tax credit which are blocked or those input tax credit which are not eligible to be claimed by the.

ITEMS ON WHICH CREDIT NOT ALLOWED IN GST. Apportionment of GST credit and Blocked Credits under Section 175 Section 171 to Section 174 deals with when Input tax credit can be claimed while ineligible or blocked credits under. Input Tax Credit is blocked on the Motor Vehicles and conveyances but there are.

Motor Vehicles and Conveyances. Input tax will include any flat rate addition which an approved person under a flat rate scheme would include in the consideration for any. Input tax is defined as the GST incurred on any purchase or acquisition of goods and.

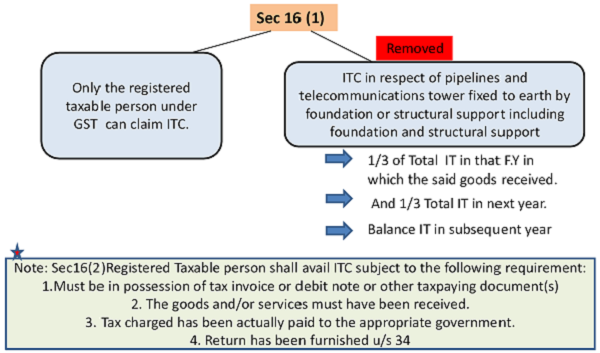

Those GST you cant claim is called Blocked Input Tax Credit. Blocked input tax refers to input tax credit that you cannot claim. Blocked Credits are dealt with under Section 175 while Section 16 deals with GST Input tax credit eligibility and conditions.

However section 175 of the CGST Act2017 specifies certain Goods and Services. When purchasing from GST-registered suppliers or importing goods into Singapore you may have incurred GST input tax. A free flow of input tax credit is a backbone of GST Law for eliminating cascading effects of taxes.

Amendments effective from 1st January 2021. GST paid on some purchases are. Before we proceed onto Blocked and Eligible credit let us first.

With this amendment ITC in respect of a debit note issued in. In this article we will discuss the concept of Blocked Credit and understand the cases where ITC can not be taken under GST. Section 175 of 2017 CGST Act defines certain Goods and Services as Blocked Credit.

This means that a taxable person cannot claim Input Tax Credit ITC for the goods or services listed under section. The date of the debit note will be considered for availing input tax credit. As per section 17 5 of CGST Act 2017 there is an entire class of cases goods services for which the ITC remains blocked such Input Tax Credit is called ineligible or blocked credits under GST.

Uppsc Blocked Credit Of Input Tax In Gst Offered By Unacademy

Overview On Input Tax Credit Under Gst Law Passed On 27th March 2017

Gst Input Tax Credit Definitions And Conditions For Claiming Gst Itc

What Is Blocked Input Tax Credit In Gst Goods Services Tax Gst Malaysia Nbc Group

Gst Blocked Input Tax Gabrieltrf

Eligibility Conditions For Taking Input Tax Credit Under Gst By Sn Panigrahi Youtube

An Overview Of Blocked Itc Under Gst Corpbiz Advisors

Delhi Govt Issued Guidelines For Unblocking Of Itc On Expiry Of 1 Year From The Date Of Blocking A2z Taxcorp Llp

Input Tax Credit Under Gst Goods And Service Tax Simple Tax India

Input Tax Credit Itc Under Gst Regime Chandan Agarwal Chandan Agarwal Co Chartered Accountants

Blocking Of Itc When Credit Not Available In Ledger Is Without Jurisdiction And Illegal Hc

When Gst Input Tax Credit Will Be Blocked From Electronic Credit Ledger Youtube

Apportionment Of Credit And Blocked Credit Under Gst

What Is Blocked Credit As Per Section 17 5 Input Tax Credit In Gst

How Gst Input Tax Credit Works Youtube

Restrictions On Input Tax Credit Us 17 5 Under Gst Blocked Credits Under Gst Youtube

New Gst Rule 86a Input Tax Credit Can Be Blocked Under Gst Baba Tax

Gst Authority Needs To Communicate Reasons For Blocking Itc Of The Taxpayer A2z Taxcorp Llp

Gst Gujarat High Court Issues Notices To Central State Over Blocking Of Itc Under Rule 86a